Many people who have just tried trading in the financial markets do so because they believe that it is a profitable way to make quick money.

Some may get good results on a demo account. However, there is a chance that once they move from a demo account to trading with real money, they will realize the harsh truth that making a consistent profit is not as easy as they initially assumed. And that trading requires a fairly large amount of knowledge and experience.

This doesn’t mean that you can’t become a profitable trader over time, but rather dispels the myth that trading in the financial markets will allow you to make money easily and quickly. In today’s article, I will offer you a point of view that will help you understand that profitable trading is possible, but you must follow some basic guidelines to get started.

Contents

Fundamentals of global financial markets

If you are just starting out as a trader, you should invest your time and effort in learning the basics of trading at the beginning. Undoubtedly, you will have to learn how to read charts, understand indicators, and realize the importance of money management and risk management. You will also have to find an effective trading method for yourself.

You can start by studying the history of the stock, futures, and currency markets to help you choose the most suitable market for trading. You need to understand and comprehend the market structure, as well as understand the balance of supply and demand that affects price movements.

You can also read some of the works of the great thinkers of technical analysis, including R. N. Elliott, W. D. Gunn, Richard Wyckoff, Charles Dow, and H. M. Hartley. These people were the pioneers of technical analysis. As well as other books on trading that I recommend for reading.

In addition, you should study some key economic indicators, such as interest rates, unemployment rates, industrial production, gross domestic product, and housing market statistics.

Once you have a basic understanding of how the global market works, what drives price, and how economics affects price fluctuations, you can then focus on specific technical or fundamental approaches that best fit your own beliefs about the market.

Apply a systematic approach to trading

When we see professional traders in movies, they often show us several monitors with dozens of different charts. Traders are constantly shouting at someone on the phone and making lots of trades, and then returning home in their Lamborghinis. These vivid images create a strong, but in many ways false, picture of what it means to be a trader.

However, if you’ve read any fact-based books about “real” traders, such as Jack D. Schwager’s Market Magic series, you know that the most successful traders in real life behave quite differently. Although most of these top traders interviewed by Schwager had different approaches to trading, the common thread that gives them an edge over most market participants is not related to their personalities, but to their ability to stick to their trading strategy with maximum risk tolerance.

Furthermore, you don’t need to be a genius to become a great trader. Yes, intelligence is important, but the simple fact is that if you want to be a consistently profitable trader, you need to start with a systematic and disciplined approach to your trading.

Being a systematic trader does not necessarily mean that you always act like a robot. You can trade at your own discretion and rely on your intuition and still be a systematic trader. By systematic approach, I mean a holistic approach that includes:

- Your psychology.

- Realistic expectations of risk-adjusted returns.

- Reliable capital management plan.

- A trading strategy that will give you a real statistical advantage in constantly changing market conditions.

Treat trading like a business

In order to become a profitable trader, you need to have a trading system that will provide you with a real advantage in the market. This system should not only determine the moments of entering and exiting trades, but also foresee situations when it is better to refrain from trading altogether.

Many novice traders enter the world of trading with great enthusiasm, spending a lot of time studying various materials and constantly trying to master the art of profitable trading. However, in the end, they often lose money because they either do not find a trading system that provides a real advantage in the market or do not devote enough time to it to allow it to demonstrate its effectiveness. This is often an indication that the chosen trading system probably does not match their personality or psychological personality type.

Some also make the mistake of misidentifying their true goals in trading. For many, the excitement and gambling aspect is attractive and they trade solely for that. They risk large amounts of money and experience a lot of emotions when the price moves in the right or wrong direction. In the end, such actions usually end badly for such investors.

Before you start trading, you need to understand that trading is a business. Although it is possible to make a significant profit by making a few trades, it is also easy to lose it. Successful trading in the long run requires a business approach and a lack of gambling.

In practice, it is worth taking a step back and carefully analyzing the situation. Try to observe your internal thought process to understand what goals you are pursuing. If you sincerely believe that you are ready to treat trading as a business, you will probably be able to trade without unnecessary emotional excitement and stress.

Understanding different market conditions to generate sustainable profits

Most traders will agree with the saying “Buy low, sell high” or “Sell high, buy low”. While common sense suggests that this is the only way to make a profit, let’s take a closer look at this idea, which is actually much more complicated than it seems at first glance.

If you have observed the price chart of any trading instrument, you will agree that the price can only do three things:

- The price may continue to rise and form an uptrend.

- The price may continue to decline and form a downtrend.

- The price can remain within a certain range.

So, there are two main types of strategies to profit from the market. Either you can trade the trend or you can trade in consolidation.

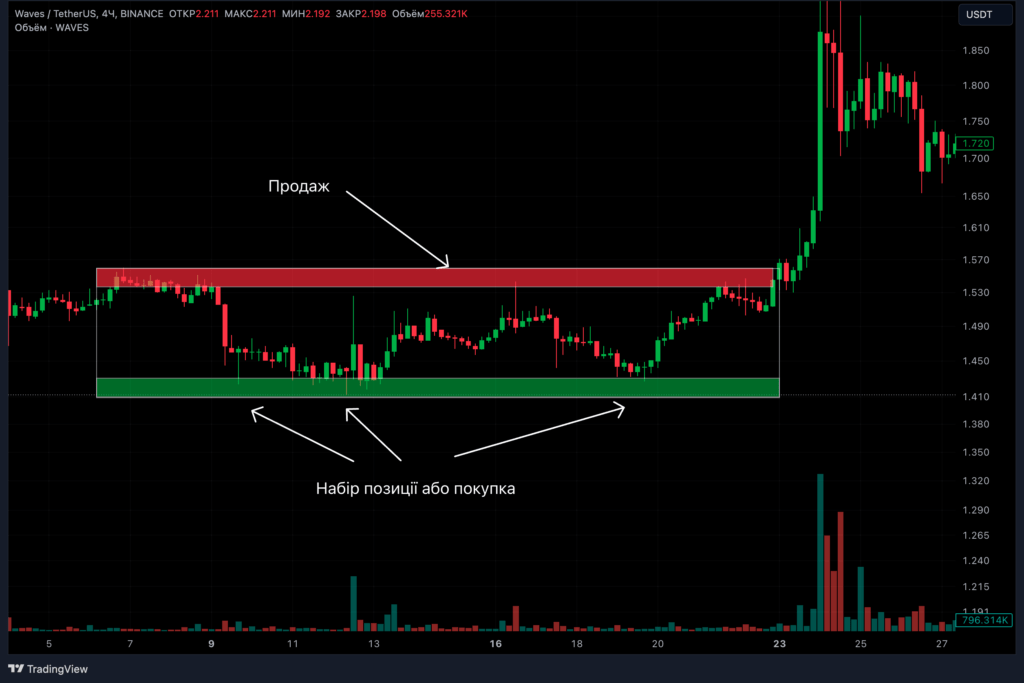

How to trade profitably in consolidation

On the chart, you can clearly identify two horizontal lines where the price finds support and resistance levels. You can be sure that the market is consolidating and is in a limited range. When you find such a market condition, it makes sense to buy near the support zone and sell above the resistance zone to make a profit.

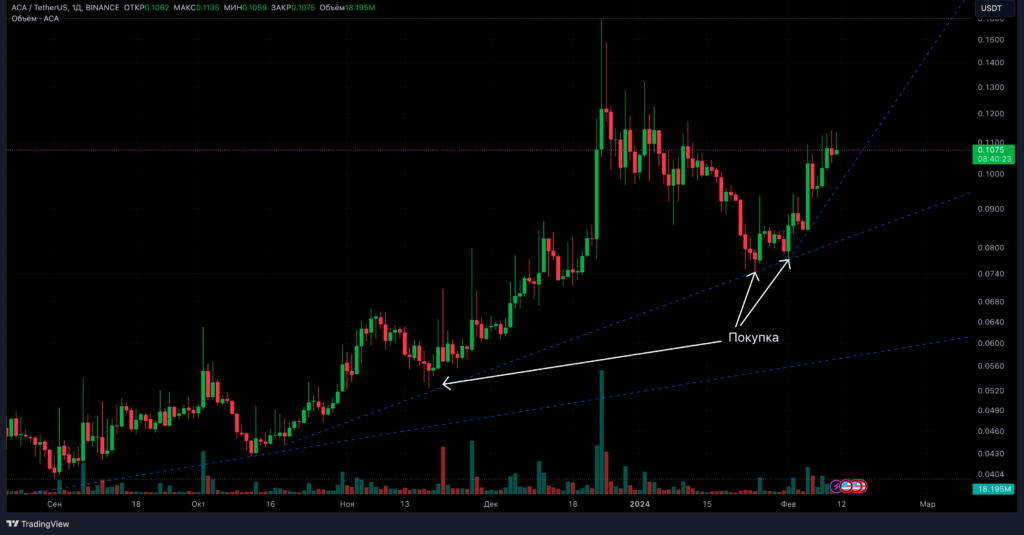

How to trade profitably on a trend

On the chart, the price is clearly in an uptrend. Here we see a trend line.

During an uptrend, there are basically two ways to profit from the market:

- Buy at the low from the uptrend trend line.

- Buy at the high when the price breaks through the resistance level.

When you try to buy at the low during an uptrend on an uptrend, you are trading against the price movement. Although you are trading with the underlying trend, there is always a chance that the trend may end and the price will reach your stop loss, forcing you to exit the market at a loss.

When you wait for the price to break through a resistance level, your chances of profit increase. In this case, you are not only trading on the side of the trend, but the price momentum will also be on your side.

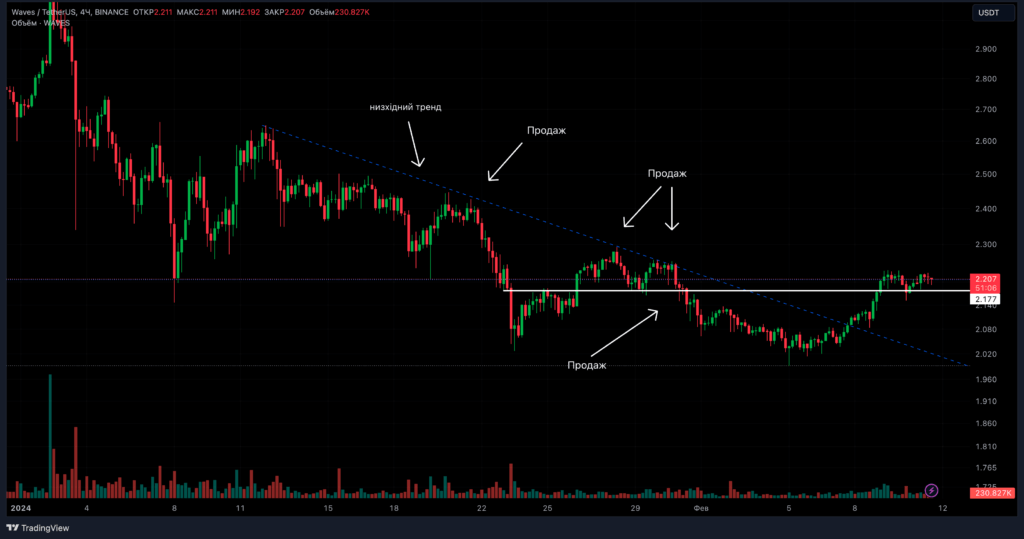

Trading on a downtrend

Similarly, during a downtrend, you should try to open a sell order near the downtrend line and also sell during a breakout below the support level.

Regardless of which trading strategy you prefer, understanding the two different types of market conditions and choosing the appropriate strategy will help you open your positions more efficiently.

Capital management is a necessary component of a stable trading system

As a trader, your main task is to be as competent as possible in risk management. Successful trading in the financial markets in the long run comes down to having a strategy of positive mathematical expectation and applying an effective risk management system. You should use a set of strict risk criteria for each trade, which will allow your trading strategy to provide you with consistent profits over time.

There are several capital management strategies, for example, risking a fixed percentage of your capital in each trade, risking a fixed amount, as well as other more complex methods of determining position size.

Regardless of which strategy you use, the essence of a money management strategy is to provide a systematic way to determine the position size of each trade. Your money management strategy should be designed in such a way that in the end, the outcome of a single trade is almost irrelevant and frees you from the psychological connection to your open positions.

Before using the money management strategy that best suits your trading system, you need to determine two aspects of your trading strategy:

The first aspect is the overall profit margin of your strategy. The second is the average return to risk ratio of your trades. Some trading strategies have a relatively low winning percentage, for example, 30%, but the profit to risk ratio is quite high, for example, 3 to 1 or more.

On the other hand, there are trading strategies in which your win rate remains at 90%. Which means that you end up making a profit on most of your trades. The problem with these types of high win percentage systems is that often the reward to risk ratio remains very low, much less than 1:1.

You can use different money management techniques for these two types of trading systems. If the winning percentage of your system is high but the return to risk ratio is low, you may be comfortable risking a slightly higher percentage of your deposit on each trade. In contrast, if the winning percentage of your trading system is low and a high profit to risk ratio is offered, you may be more cautious about the risk per trade.

In any case, you should always try to limit the maximum drawdown, as there is always a risk of getting a margin call.

How to trade profitably? Results

If you are feeling frustrated because you are not making consistent profits from your trading, you are not alone. Most successful traders paid a high price to gain experience that helped them in the future.

To become a successful trader, you have to invest a lot of time. You have to test thoroughly and develop a trading system that offers the right balance in terms of win rate and profit-to-risk ratio. At the same time, you need to consider your temperament.

Be prepared to spend a lot of time analyzing your trading technique with different risk management techniques. Applying different parameters to your trading model based on backtesting can show how your trading strategy has performed in different market conditions in the past.

If you have a trading strategy that can be profitable in different market conditions or at least helps you stay out of the market and not lose money, then you need to apply a smart money management approach.

Most traders never get this far. If you can implement these basic steps, then you will be ahead of most traders and will be able to eventually trade successfully and profitably.